Spring is here, which means it’s time to declutter, refresh, and get organized. And that doesn’t just stop at your office or home. Your employee benefits plan needs a deep clean, too.

An outdated benefits package is like an over-filled garage—messy, inefficient, and frustrating. If your business only looks at benefits once a year when the renewal hits your inbox, you’re already playing defense. It’s time to get proactive, start planning ahead, and make sure your benefits actually work for your employees before you’re hit with rising costs and outdated options.

Here’s how to spring clean your benefits strategy and set your business up for long-term success.

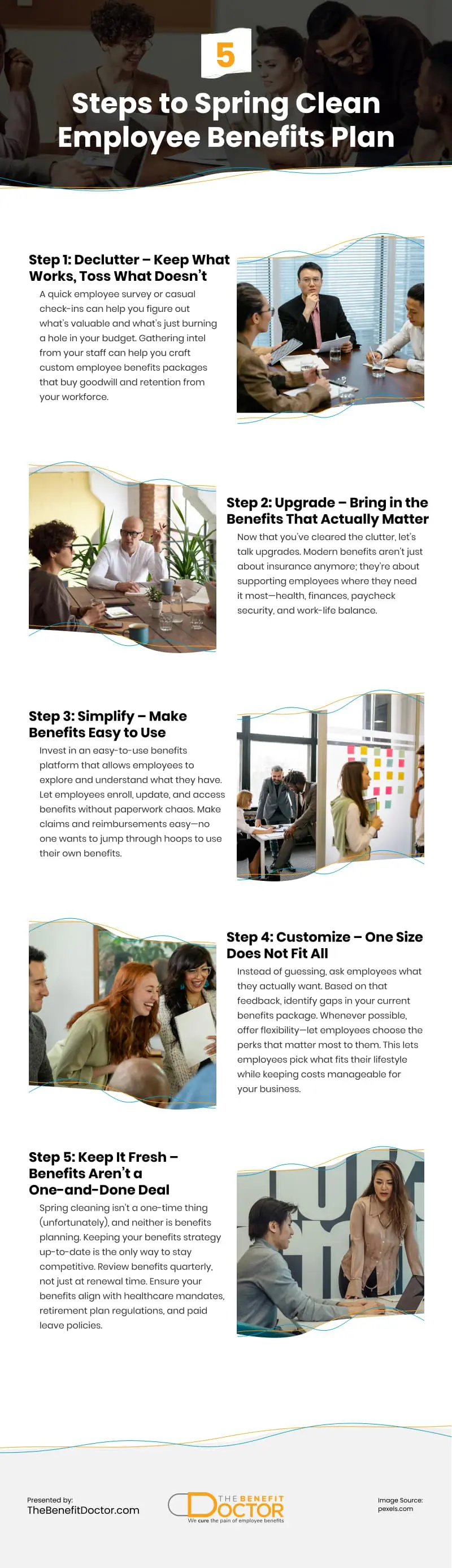

Step 1: Declutter – Keep What Works, Toss What Doesn’t

Before you start chucking things, take stock. Just like you wouldn’t throw out a perfectly good coffee maker (a crime, honestly), don’t ditch benefits that employees actually use and love.

Sort Through Employee Usage and Feedback

- Are employees using the benefits you offer, or are they collecting dust like that treadmill-turned-clothes-rack in your basement?

- Do employees even know what benefits they have? If they’re confused, they’re probably not using them.

- Are you wasting money on perks no one cares about or uses? If your wellness app has more virtual tumbleweeds than logins, it might be time to cut it.

A quick employee survey or casual check-ins can help you figure out what’s valuable and what’s just burning a hole in your budget. Gathering intel from your staff can help you craft custom employee benefits packages that buy goodwill and retention from your workforce.

Crunch the Numbers

- Are you overpaying for underused benefits?

- Could you negotiate better deals on existing offerings?

- Is your competition offering better perks and luring away your top talent?

If your benefits aren’t being used or appreciated, they’re not benefits—they’re just another expense. Time to clean house.

Step 2: Upgrade – Bring in the Benefits That Actually Matter

Now that you’ve cleared the clutter, let’s talk upgrades. Modern benefits aren’t just about insurance anymore; they’re about supporting employees where they need it most—health, finances, paycheck security, and work-life balance.

Health and Wellness Perks That Employees Want

For benefits to matter to your employees, they must be usable. And if they keep your employees healthy and calling out less often? That’s a double win for you. Health and wellness perks, when done badly, are unused gimmicks. When done well, they keep your people both happy and healthy.

- Telemedicine – Because no one wants to sit in a waiting room if they can see a doctor from their couch.

- Mental Health Support – An Employee Assistance Program (EAP) or therapy stipends go a long way.

- Gym Membership Discounts – A healthy team is a productive team. And a team that calls out sick a lot less often.

- Comprehensive Healthcare Plans – Give your employees comprehensive, cost-effective healthcare coverage that aligns with their needs

If your benefits aren’t being used or appreciated, they’re not benefits—they’re just another expense. Spring cleaning means taking out the trash.

Retirement and Financial Wellness

Picture this: your employees are stressed about how they are going to pay the electric bill or whether they are going to have to celebrate their 80th birthday in your break room because they won’t ever be able to afford to retire. That doesn’t sound like a set up for prime productivity, does it?

Now, imagine your benefits have helped them understand finances, get their debt under control, and start building a nest egg for their future. Which set of employees is going to feel better taken care of and more loyal?

When you offer benefits that increase financial stability and reduce stress, your employees will notice.

- 401(k) Matching – Employees who feel secure about their future will stick around.

- Student Loan Assistance – A game-changer for younger employees drowning in debt.

- Financial Literacy Programs – Help your team make smarter money moves.

- Paycheck Protection Insurance – Disability and paycheck protection insurance can provide peace of mind when life throws a curveball.

Work-Life Balance Boosters

Anything that helps your people feel more in control of their time is a win.

- Flexible Schedules and Remote Work Options – Employees now expect flexibility. Meet them where they are. If your workflow allows it, offer flex schedules or staggered work hours.

- Paid Parental Leave – Retain top talent by actually supporting growing families.

- More PTO or Unlimited Vacation – Encourage breaks to prevent burnout. And preventing burnout prevents turnover and sicktime.

Benefits that don’t reflect what today’s workforce actually wants are just expensive clutter.

Step 3: Simplify – Make Benefits Easy to Use

A complicated benefits system is like a junk drawer—you know there’s something useful in there, but good luck finding it.

Go Digital

Invest in an easy-to-use benefits platform that allows employees to explore and understand what they have. Let employees enroll, update, and access benefits without paperwork chaos.

Make claims and reimbursements easy—no one wants to jump through hoops to use their own benefits. Submitting claims with just a few clicks means less frustration and wasted time

Provide access to plan details that doesn’t require digging through email attachments or outdated pamphlets.

Actually Explain the Benefits

If you are confused by the benefits lingo, so are your employees. Ditch the corporate-speak and try this instead:

- Annual benefits meetings – A quick walk-through prevents confusion later.

- Short explainer videos – No one reads a 20-page benefit guide, but they’ll watch a 2-minute video.

- One-on-one consultations – Personalized guidance makes a huge difference.

Step 4: Customize – One Size Does Not Fit All

Your employees have different needs, so why offer a cookie-cutter benefits package? Think of benefits like a custom wardrobe—some need extra shelving, others need more hanging space.

Personalized Benefits = Happy Employees

Instead of guessing, ask employees what they actually want. Based on that feedback, identify gaps in your current benefits package. Whenever possible, offer flexibility—let employees choose the perks that matter most to them.

Consider a Mix of Core and Optional Benefits

Rather than giving every employee every option, let them pick and choose which add-ons fit their needs. Core benefits should include an employee group health plan, disability insurance, PTO, and 401(k). Layer that with customizable perks. That might include wellness stipends, tuition reimbursement, legal aid, or pet insurance.

This lets employees pick what fits their lifestyle while keeping costs manageable for your business. When it comes to spring cleaning, one man’s trash is another man’s treasure. That applies to benefits, too. Your crazy cat lady will appreciate insurance for Chairman Meow, while the office gym rat will use the wellness stipend instead.

Step 5: Keep It Fresh – Benefits Aren’t a One-and-Done Deal

Spring cleaning isn’t a one-time thing (unfortunately), and neither is benefits planning. You wouldn’t deep-clean once a year and call it good—so why do that with benefits?

Keeping your benefits strategy up-to-date is the only way to stay competitive.

- Review benefits quarterly, not just at renewal time. Stay ahead of trends and rising costs.

- Stay compliant. Ensure your benefits align with healthcare mandates, retirement plan regulations, and paid leave policies.

- Keep an eye on competitors. Use industry reports to stay competitive. If you’re offering less than the industry standard, you’re making it easy for employees to jump ship.

A Fresh Start for Your Employee Benefits Plan

Spring isn’t just about clearing out the garage or dusting off shelves—it’s about setting yourself up for success. A well-structured employee benefits plan boosts morale, improves retention, and keeps your workforce engaged.

By proactively reviewing, upgrading, and simplifying benefits, you’ll create a package that works for both your employees and your bottom line—without waiting for a renewal shock to force a change.