You’ve seen it happen—maybe to you, maybe to someone on your team. You follow the rules, go to the doctor, submit the claim… and boom: denial. Suddenly, a “covered” service turns into a costly surprise. Now you’re stuck sorting through jargon, fine print, and red tape with a growing sense of frustration.

Before you know it, you’re running in circles and jumping through hoops you never knew existed. You may quickly tire and be tempted to throw in the white flag, but you have power. And it starts with knowing your rights—and how to use them.

Whether you’re fighting for yourself or helping your team navigate benefits, this guide will help you stay sane and confidently navigate a denial of coverage.

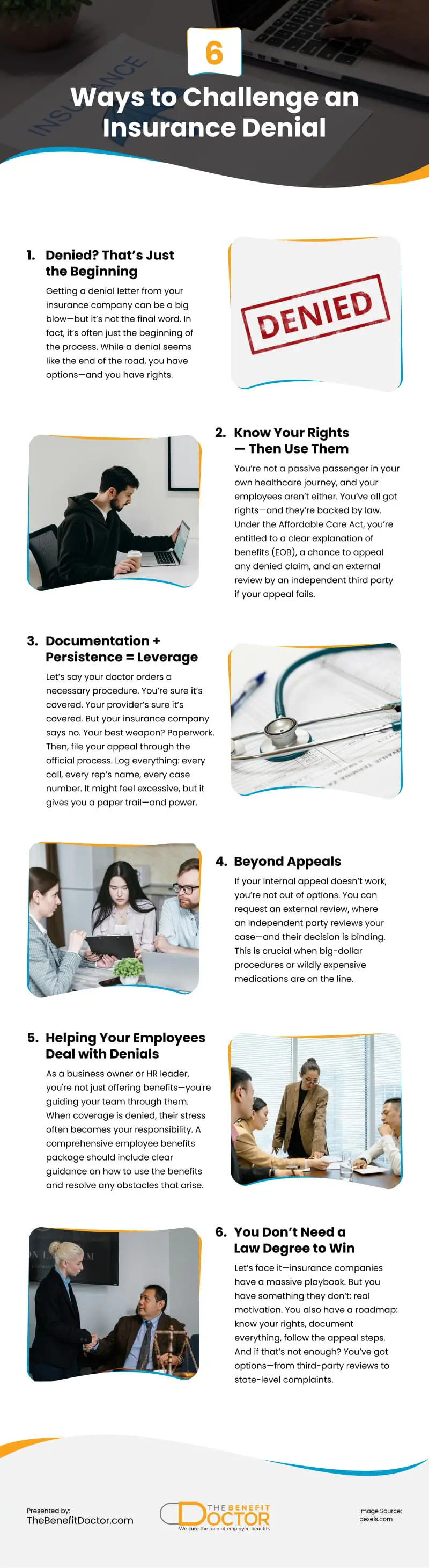

Denied? That’s Just the Beginning

Getting a denial letter from your insurance company can be a big blow—but it’s not the final word. In fact, it’s often just the beginning of the process. While a denial seems like the end of the road, you have options—and you have rights.

Under federal law, every patient has the right to appeal an insurance denial. And many appeals are successful, especially when you provide the right documentation and follow the steps carefully.

Sure, it can take some time and effort. And yes, the process feels daunting. But that’s why a clear strategy—and the right support—can make all the difference. You can advocate for your care and improve your chances of a positive outcome.

Know Your Rights—Then Use Them

You’re not a passive passenger in your own healthcare journey, and your employees aren’t either. You’ve all got rights—and they’re backed by law.

Under the Affordable Care Act, you’re entitled to:

- A clear explanation of benefits (EOB)

- A chance to appeal any denied claim

- An external review by an independent third party if your appeal fails

You also have the right to:

- Receive care in a timely manner

- Be informed about your options

- Access your medical records

But rights are only useful if you use them.

Start by reading the denial letter carefully. Find the reason code or explanation. Then respond with documentation—not outrage. Push back with facts, not frustrations.

Documentation + Persistence = Leverage

Let’s say your doctor orders a necessary procedure. You’re sure it’s covered. Your provider’s sure it’s covered. But your insurance company says no.

Your best weapon? Paperwork.

Here’s what to collect:

- A letter of medical necessity from your provider

- A copy of your policy or coverage guidelines

- Supporting documentation (lab results, authorizations, notes from prior calls)

Then, file your appeal through the official process. Log everything: every call, every rep’s name, every case number. It might feel excessive, but it gives you a paper trail—and power.

Also important: insurers are legally required to respond within certain timelines. For urgent claims, you may get a decision within 72 hours.

Persistence sends a message: “I’m not going away.” That alone increases your odds of a reversal.

Beyond Appeals

If your internal appeal doesn’t work, you’re not out of options. You can request an external review, where an independent party reviews your case—and their decision is binding.

This is crucial when big-dollar procedures or wildly expensive medications are on the line.

You can also file a complaint with your state’s Department of Insurance or bring in a patient advocate or legal advisor.

What you’re doing isn’t just standing up for yourself. You’re holding the insurance company accountable—and that matters.

Helping Your Employees Deal with Denials

As a business owner or HR leader, you’re not just dealing with your own benefits—you’re helping your team deal with theirs.

And when someone’s coverage gets denied, their stress becomes your problem. Offering a comprehensive employee benefits package isn’t just about providing the benefits. It’s about making sure your staff knows how to use them and what to do when they hit an obstacle.

How do you help without getting buried in every dispute?

Start by building a benefits-literate culture. When employees understand how coverage works, they feel less blindsided—and they stop seeing your company as the enemy if something goes wrong. Health insurance benefits for employees work best when those employees know what they have and how to use it.

Here’s how to make it easier:

- Create quick one-pagers or explainer videos on “What to Do If Your Claim Is Denied”

- Offer a go-to HR contact to walk them through the appeal process

- Promote tools like care advocates or employee assistance programs (EAPs)

You don’t need to solve every problem. But you can empower your team to handle issues without panic—and reduce company-wide stress in the process.

You Don’t Need a Law Degree to Win

Let’s face it—insurance companies have a massive playbook. But you have something they don’t: real motivation.

This is about your health, your family, your finances, your employees. You have skin in the game.

You also have a roadmap: know your rights, document everything, follow the appeal steps. And if that’s not enough? You’ve got options—from third-party reviews to state-level complaints.

You won’t win every time—but you’ll help hold your insurers responsible for their end of the deal.

At The Benefit Doctor, we help employers and employees cut through the chaos, make sense of the system, and fight for what’s fair. If your current broker disappears the second things get tough, it’s time for an upgrade.

You have the right to be heard. Let’s build a strategy that makes sure you are.

Video

Infographic

Health insurance claim denials can be frustrating, especially after completing all the necessary steps—consulting the doctor and submitting the required paperwork. However, a denial doesn’t have to be the end of the road. Find out in this infographic tips to challenge an insurance denial effectively.