You’ve found the perfect candidate for your open position. They’ve got the skills, the experience, and the personality to fit right in with your team. But then, they take a look at your benefits package and… womp womp. They politely decline your offer and move on to the next offer.

It’s a tale as old as time in the business world. But here’s the good news: it doesn’t have to be your story. With a competitive benefits package that speaks to what employees really want, you can attract and retain the best of the best. And trust us, when you have a team of rockstars, there’s no limit to what your company can achieve.

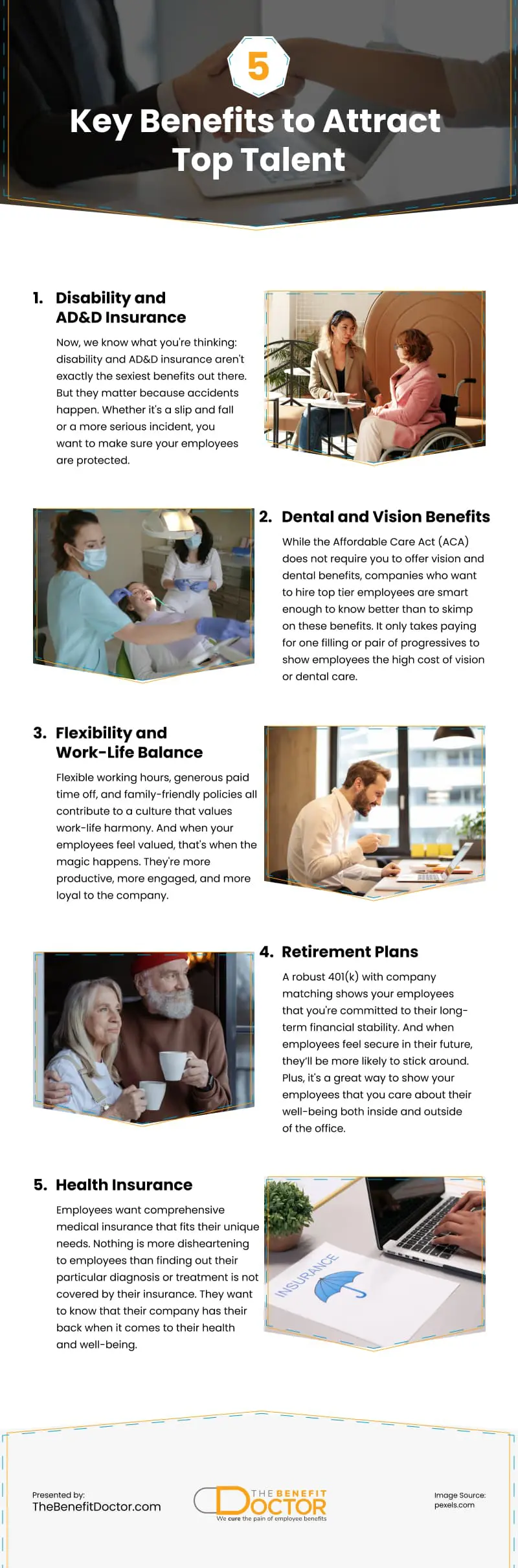

Building Your Best Benefits Package

Every part of your benefits package has a role to play. Some are flashy and like to sit center stage—-think bonuses, 4-day work weeks, and extra holidays. Others wait silently backstage ready to jump into action when one of life’s dreaded “what if” scenarios comes into play. You know, the incidents we all hope and pray will never happen, but all too often do.

The ideal benefits package accounts for both the expected and unexpected. Like a house, it is built on a solid foundation, surrounded by sturdy walls, and covered by the all-important roof. Each component is essential and without any one piece, it would crumble like a house of cards.

So, let’s dive into the key benefits every employee wants and every employer should provide.

1. Disability and AD&D Insurance

Now, we know what you’re thinking: disability and AD&D insurance aren’t exactly the sexiest benefits out there. But they matter because accidents happen. Whether it’s a slip and fall or a more serious incident, you want to make sure your employees are protected.

Imagine one of your key employees gets injured and can’t work for a few months. Without disability insurance, they’re left without an income—and you’re left without a valuable team member. By offering both short-term and long-term disability options, you give your employees peace of mind. It is the sure foundation of your benefits package. Everything else builds on it.

2. Dental and Vision Benefits

While the Affordable Care Act (ACA) does not require you to offer vision and dental benefits, companies who want to hire top tier employees are smart enough to know better than to skimp on these benefits. It only takes paying for one filling or pair of progressives to show employees the high cost of vision or dental care. Why make them foot the bill out of pocket when there are so many cost-effective vision and dental plan options available?

These benefits are the strong, sturdy walls that protect employees from the high cost of care. Employees use them regularly and expect to see them when they look at your benefits.

3. Flexibility and Work-Life Balance

They may sound like benefits buzzwords, but these aren’t just nice-to-haves—they’re non-negotiables. With remote work options in many industries, employees expect companies to trust them to get the job done, no matter where they are. And who doesn’t love the idea of working in their pajamas every once in a while?

But it’s not just about remote work. Flexible working hours, generous paid time off, and family-friendly policies all contribute to a culture that values work-life harmony. And when your employees feel valued, that’s when the magic happens. They’re more productive, more engaged, and more loyal to the company.

4. Retirement Plans

When it comes to retirement plans, think of it this way: you’re not just helping your employees save for their future, you’re investing in your company’s future too. A robust 401(k) with company matching shows your employees that you’re committed to their long-term financial stability. And when employees feel secure in their future, they’ll be more likely to stick around. Plus, it’s a great way to show your employees that you care about their well-being both inside and outside of the office.

5. Health Insurance

Like the roof over your head at night, a proper health insurance plan is essential. And we’re not just talking about basic coverage here. Employees want comprehensive medical insurance that fits their unique needs. Nothing is more disheartening to employees than finding out their particular diagnosis or treatment is not covered by their insurance. They want to know that their company has their back when it comes to their health and well-being.

A single, healthy 20-something has very different health needs than a 40-something with a family. By offering tiered health plans, you give your employees the flexibility to choose what works best for them. And when your employees feel like their needs are being met, they’re not shopping around for an employer with better benefits.

Benefits That Matter

We know that creating a standout benefits package can feel overwhelming. But by focusing on the benefits that truly matter to your employees and support their most important needs you can transform your workplace culture and attract top talent like never before.

And that’s where BenDoc comes in. Our customized approach to building a benefits house helps you protect employees from the storms of life and provide unparalleled support. We’ll help you craft a benefits strategy that not only wows your employees but also delivers measurable results for your business. We’ll be your trusty sidekick, helping you navigate the complex world of benefits and come out on top.

So what are you waiting for? It’s time to ditch the one-size-fits-all approach and invest in benefits that truly make a difference. Your employees—and your bottom line—will thank you.

Video

Infographic

A competitive benefits package that meets employee needs can help you attract and retain top talent. With a strong team, your company can achieve great success. Check out this infographic for the essential benefits every employee wants and every employer should offer.