When your employees get their insurance cards in the mail, many follow the same routine. They glance at it, shrug, and file it away, probably in that same place where sunglasses and free-smoothie punchards go to die. But when it’s time to use that card, confusion can kick in fast.

Insurance cards often feel like a jumble of numbers, codes, and abbreviations. For many people, especially those new to employer-sponsored plans, it’s unclear what’s important or how to use the information. And if no one explains it? That confusion can keep employees from getting the care they need.

Helping your team understand their insurance cards is a practical way to make your benefits more accessible and more effective.

Why Insurance Cards Trip People Up

These cards aren’t designed for clarity. Carriers, not users, create them, and it shows. Your employees may not know what to hand over at a doctor’s office, which ID to give at the pharmacy, or what any of the acronyms mean. “PCP”? “Group number”? “RX BIN”? It has all the charm and clarity of an IRS form.

The learning curve can feel steep, especially for employees who recently came off a parent’s plan, changed carriers, or are navigating health insurance for the first time. And when they don’t feel comfortable asking questions, they may delay care, pay more than necessary, or avoid using their benefits altogether. Your carefully crafted benefits plan suddenly becomes a source of frustration, rather than a retention tool.

Remember that Clarity Creates Confidence

When you provide health coverage, you’re investing in your team’s well-being. But that investment only works if people actually use it—and use it correctly. That’s where a little education goes a long way.

Clear communication helps employees make smarter decisions, use in-network services, and avoid billing issues. It also sends an important message: “We’ve got your back.” That kind of support builds trust, boosts morale, and reduces stress for everyone involved.

The need for clarity is where employee benefits insurance brokers can offer real value. They take the mystery out of employee benefits, including insurance cards. They provide training that ensures everyone knows what they have and how to use it. Whether you bring in expert help or handle things in-house, there are plenty of ways to make insurance card education simple and effective.

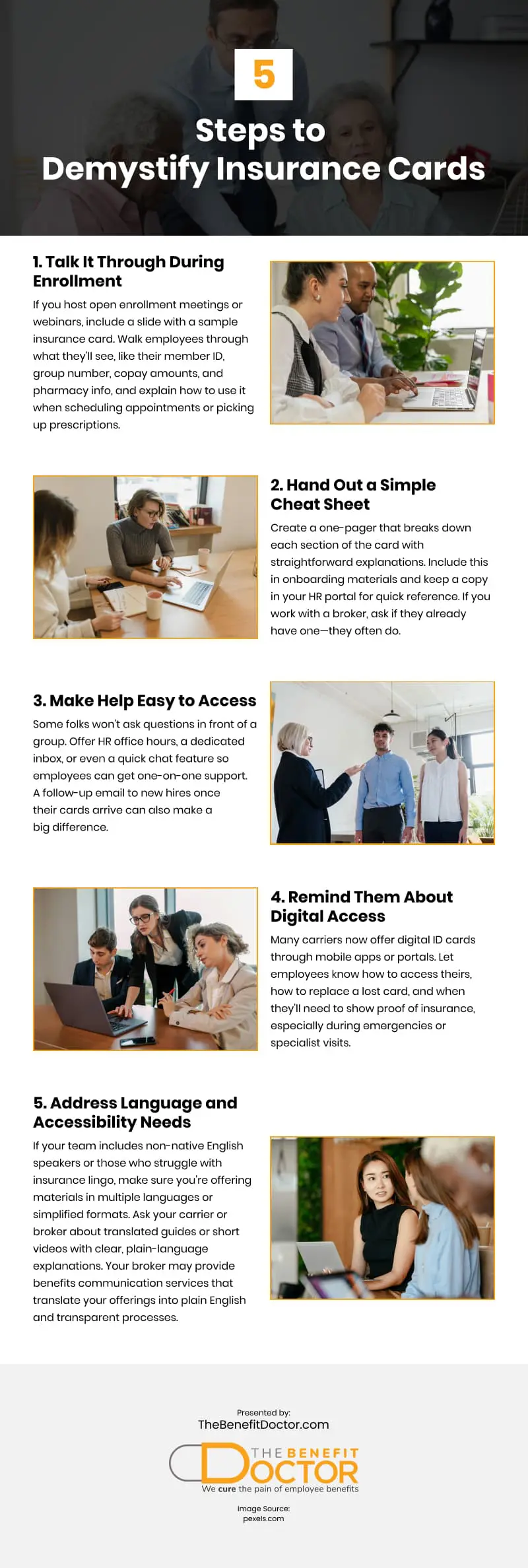

Demystify the Card with These Five Steps

1. Talk It Through During Enrollment

If you host open enrollment meetings or webinars, include a slide with a sample insurance card. Walk employees through what they’ll see, like their member ID, group number, copay amounts, and pharmacy info, and explain how to use it when scheduling appointments or picking up prescriptions.

2. Hand Out a Simple Cheat Sheet

Create a one-pager that breaks down each section of the card with straightforward explanations. Include this in onboarding materials and keep a copy in your HR portal for quick reference. If you work with a broker, ask if they already have one—they often do.

3. Make Help Easy to Access

Some folks won’t ask questions in front of a group. Offer HR office hours, a dedicated inbox, or even a quick chat feature so employees can get one-on-one support. A follow-up email to new hires once their cards arrive can also make a big difference.

4. Remind Them About Digital Access

Many carriers now offer digital ID cards through mobile apps or portals. Let employees know how to access theirs, how to replace a lost card, and when they’ll need to show proof of insurance, especially during emergencies or specialist visits.

A digital card can be the difference between heading straight to the ER and digging around in a junk drawer or stuffed wallet before seeking care.

5. Address Language and Accessibility Needs

If your team includes non-native English speakers or those who struggle with insurance lingo, make sure you’re offering materials in multiple languages or simplified formats. Ask your carrier or broker about translated guides or short videos with clear, plain-language explanations.

Your broker may provide benefits communication services that translate your offerings into plain English and transparent processes. That allows you to outsource most of these steps to someone who does this for a living. They know the best ways to communicate benefits information and the common questions that go unasked but make a difference to your people.

Keep the Conversation Going

Helping employees understand their insurance card is just the beginning. It opens the door to bigger topics like choosing providers, using telehealth, or managing deductibles.

To keep benefits top of mind year-round, consider:

-

- Monthly emails highlighting helpful plan features

- Bite-sized Q&A sessions during lunch or team meetings

- Quick surveys to see where employees need more guidance

These small touchpoints reinforce your commitment and increase the value of your existing benefits without raising your costs.

Be More Than a Provider: Be a Guide

You don’t need to be an insurance expert to make a difference. You help your team feel more confident and capable by stepping in with practical, relatable support. That leads to better care decisions, fewer billing surprises, and a stronger sense of trust across the board.

An insurance card may look like just another piece of plastic, but when your employees know how to use it, it becomes a tool for smarter choices and better outcomes.

Want to make your benefits easier to understand and easier to use? Start by making the basics clear and watch how far that clarity can take your team.

Video

Infographic

Insurance cards can be confusing, often filled with numbers, abbreviations, and fine print, making them hard to understand—especially for employees who are new to employer-sponsored plans. This infographic breaks down practical steps to make insurance cards easier to understand.