You don’t need an advanced degree in health insurance to offer your team a solid benefits package. But you do need to know what questions to ask.

Sitting down with your employee benefits broker and creating a plan shouldn’t be like you’re ordering off a fast-food menu. You get a great benefits package when you build a plan that fits your team like a tailored suit. It’s practical, comfortable, something to be proud of.

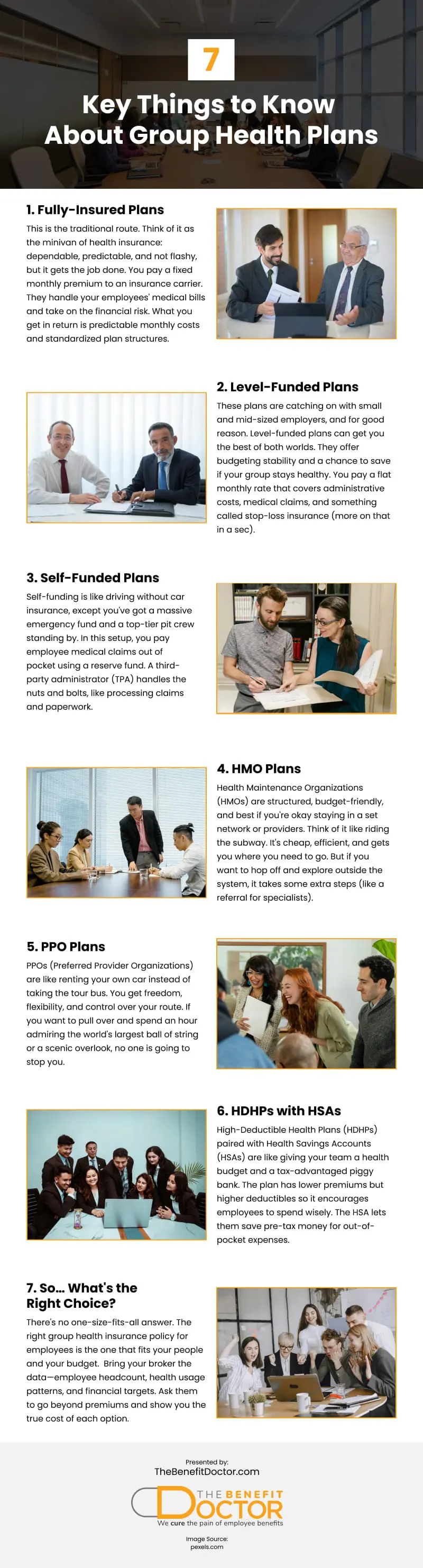

Let’s walk through the most common types of group health insurance you’ll want to consider. Think of this as your health insurance cheat sheet, without all the complicated jargon.

Fully-Insured Plans

This is the traditional route. Think of it as the minivan of health insurance: dependable, predictable, and not flashy, but it gets the job done.

You pay a fixed monthly premium to an insurance carrier. They handle your employees’ medical bills and take on the financial risk. What you get in return is predictable monthly costs and standardized plan structures. A fully-insured option also means minimal effort on your end as the insurer does most of the work.

It’s a solid choice if you value simplicity and don’t want surprises. The downside? If your team’s pretty healthy, you might end up paying more in premiums than you get back in benefits. It’s kind of like paying for a gym membership and only showing up twice a year.

Like car insurance, you pay whether or not you get into an accident. If nothing happens, you’ve essentially paid for peace of mind. But if things go 10-car-pileup sideways you’ll be glad you had it.

Bottom line: You’re paying for predictability. It’s safe, but not necessarily the cheapest in the long run.

Level-Funded Plans

These plans are catching on with small and mid-sized employers, and for good reason.

Level-funded plans can get you the best of both worlds. They offer budgeting stability and a chance to save if your group stays healthy.

You pay a flat monthly rate that covers administrative costs, medical claims, and something called stop-loss insurance (more on that in a sec). If claims come in lower than expected, you might even get some money back. That’s right. You could get a refund.

Add to that the stop-loss insurance. It is your financial parachute. If a major claim comes in—think cancer treatment or an organ transplant—you only pay up to a set limit. After that, the insurance swoops in to cover the rest.

Imagine running a food truck with a fixed grocery budget. If business is slow and you don’t use all your ingredients, you get a rebate at the end of the month. If suddenly everyone in town wants tacos and you run out, your supplier steps in and handles the overflow. Boom. Covered. Only instead of tacos, it’s treatment for bronchitis or a broken ankle.

Before selecting a level-funded plan, ask your broker:

-

- How is our monthly rate calculated?

- What’s the stop-loss limit?

- Will we get reporting so we can actually track this stuff?

If your claims run low, you may get money back. But that only happens if the plan is built with precision.

Level-funded options are popular employee benefit plans for small businesses because they blend the stability of fully-insured plans with the flexibility and potential savings of self-funding. As long as your broker gets it right, and not all of them do. That makes it critical that you choose an independent employee benefits consultant with a history of results and strong industry knowledge.

Self-Funded Plans

Self-funding is like driving without car insurance, except you’ve got a massive emergency fund and a top-tier pit crew standing by.

In this setup, you pay employee medical claims out of pocket using a reserve fund. A third-party administrator (TPA) handles the nuts and bolts, like processing claims and paperwork.

It’s not for the faint of heart. This style of benefits plan is best suited for bigger businesses with a strong, steady cash flow and a good handle on risk management. Self-funded plans also give you easy access to detailed claims data.

Let’s bring it back to cars. This is like owning a luxury sports car and opting out of insurance. If you never crash it, you save money. But if you drive it into a lake? You’d better hope your rainy-day fund is deep. If you’ve saved so much money over all the years you didn’t have an accident, it may be. Or it may not be, if you have a few crash-filled years or your accident happens in the first year you start saving.

If you think you want a self-funded plan, ask your broker:

-

- What’s the stop-loss coverage?

- How do we stay compliant with ERISA?

- What happens if someone racks up a huge medical bill?

HMO Plans

Health Maintenance Organizations (HMOs) are structured, budget-friendly, and best if you’re okay staying in a set network or providers. Think of it like riding the subway. It’s cheap, efficient, and gets you where you need to go. But if you want to hop off and explore outside the system, it takes some extra steps (like a referral for specialists).

Going with an HMO gives you consistent premiums that are lower than some other options, but flexibility takes a hit. For HMO plans to work, you probably need a team that is mostly local. If they are spread out, it’s tough to provide solid care access to everyone.

Consider this approach if your employees are okay with a tighter provider network, rather than being able to pick any doctor and head to the dermatologist without their primary doc acting as gatekeeper. If you aren’t sure if that will work for them, ask, or talk to your broker about the best ways to discuss this with your staff.

Just make sure your team’s preferred doctors and hospitals are in the network. Otherwise, that “great deal” turns into a frustration fest. You don’t want to end up paying for a health plan that makes your employees more frustrated and less loyal than if you’d done nothing at all.

PPO Plans

PPOs (Preferred Provider Organizations) are like renting your own car instead of taking the tour bus. You get freedom, flexibility, and control over your route. If you want to pull over and spend an hour admiring the world’s largest ball of string or a scenic overlook, no one is going to stop you.

Your team can visit any doctor, in or out of network. No referrals needed. But that freedom comes with higher premiums and deductibles.

A PPO might be a good pick if your team values choice and is willing to pay a bit more to have it. This style also works well if you have employees with ongoing or complex medical needs.

If you and your people don’t mind paying a little more for broader access and direct access to specialists, a PPO might be the right fit.

Top questions for your broker include:

-

- What’s the in-network vs. out-of-network coverage like?

- Can we design a cost-sharing model that won’t break the bank?

HDHPs with HSAs

High-Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs) are like giving your team a health budget and a tax-advantaged piggy bank.

The plan has lower premiums but higher deductibles so it encourages employees to spend wisely. The HSA lets them save pre-tax money for out-of-pocket expenses.

Think of it like shopping at a bulk store. You save big, but only if you plan ahead. Otherwise, you’re stuck with a 10-pound tub of peanut butter and no meals to go with it.

It’s a great combo if people understand how to use it. And a lot of folks don’t. If you choose this coverage, you’ll need to think about how to educate your team. A top-notch broker can help you devise a plan and implement it.

Ask your broker:

- Should I chip in to employees’ HSAs? If so, how much is the right amount?

- How will we explain this to employees without making their eyes glaze over?

- Is there a game plan for education?

Done right, this setup empowers employees and saves money for everyone. Done wrong, it’s just confusing.

So… What’s the Right Choice?

There’s no one-size-fits-all answer. The right group health insurance policy for employees is the one that fits your people and your budget.

Bring your broker the data—employee headcount, health usage patterns, and financial targets. Ask them to go beyond premiums and show you the true cost of each option. And make sure they help you roll it out clearly to your team. Because even the best coverage won’t help if your employees don’t understand it.

So go ahead. Ask the questions, challenge the assumptions, and get it right. Your people are watching. And they’re absolutely worth it.

Video

Infographic

Choosing the right group health insurance for your team does not require mastering insurance jargon; it is about understanding your options and asking the right questions. This infographic reveals seven key things to know about group health plans.