Every year, countless business owners experience the same déjà vu: a rushed email, a half-hearted “your rates went up, but that’s normal,” and a renewal form sitting in front of them, begging for a rubber-stamp approval.

It must be renewal season again.

This is the moment your broker should be working harder than ever. They should be digging into claims data, negotiating rates, and earning every penny of that commission they collect year-round. If your employee benefits consultant has gone radio silent or dropped a last-minute renewal bomb on your desk, here’s what they should actually be doing instead:

1. Negotiating Like It’s Their Money on the Line

The first and most obvious thing an employee benefits insurance broker should do is push back on rate hikes. Their job isn’t to shrug and say, “Everyone’s seeing increases this year.” It’s to dissect your claims data, identify cost drivers, develop relationships with insurers, and negotiate aggressively.

If your utilization has been steady, there’s no reason your premiums should spike unchecked. A broker who doesn’t fight for better pricing is basically being paid to shuffle paperwork. That’s hardly the protection your budget deserves.

Your broker should treat your dollars like their own. If they’re not challenging increases, they’re protecting their commission, not your company.

2. Shopping the Market, Not Just Renewing Last Year’s Plan

Would you buy a car or rent a home without comparison shopping? Then why choose a broker who blindly renews your benefits without exploring better options?

A strong broker aggressively explores the market, gathering fresh quotes, evaluating level-funded or self-funded options, and identifying ways to make your dollars go further.

If they only present the same carrier and plan with a new price tag, that’s convenience masquerading as stability. A good broker does the legwork, analyzes the numbers, asks questions, and comes back with options that make you look smart to your team and your CFO.

3. Explaining the “Why” Behind Every Change

If your renewal conversation sounds anything like this: “Your rates went up 8%. Sign here,” you’re not getting the whole picture.

No explanation. No context. No plan. That’s unacceptable.

Part of your broker’s job is to translate insurance jargon into plain English. You deserve context. Why did premiums increase? Was it a claims spike? A demographic shift? Carrier adjustments?

Understanding the “why” leads to informed decisions rather than blind guesses. If you’re asking all the questions and getting half-answers, it’s your broker, not your plan, that’s failing.

4. Running a Mid-Year Review

Waiting until renewal season to talk to your broker is like fixing a leak after the basement floods. There’s some value in it, but it’s certainly not the best or least expensive course of action.

The right broker checks in mid-year, long before pressure sets in, reviewing utilization reports, flagging underused benefits, and identifying overpayments. By the time renewal season arrives, it’s fine-tuning, rather than a full-on emergency.

If you don’t hear from your broker for 11 months of the year, they shouldn’t be your broker.

5. Building a Story, Not a Spreadsheet

Your renewal shouldn’t feel like a data dump. Spreadsheets don’t negotiate. Stories do.

Your broker should turn your data into a narrative that carriers can’t ignore. They can demonstrate that your uptake of preventive care has reduced claims. They should explain why your team’s engagement justifies a rate freeze. If you have a successful wellness program, your carrier should be aware of it, and your broker should be the one telling that story.

If your renewal “presentation” is just a few slides with totals, they’re not adding value.

6. Helping Employees Understand Benefits

Even the best benefits plan is worthless if no one understands it. Handing employees a 40-page packet at renewal time and walking away won’t cut it.

A proactive broker helps you:

- Simplify complex plans into clear, plain language that your team can understand.

- Run workshops, Q&A sessions, or short videos to explain coverage.

- Put together communications year-round.

- Ensure employees know how to use paycheck protection insurance and other key benefits.

If employees aren’t using their benefits, your broker should address that, not ignore it or make it your problem to solve.

7. Bringing New Ideas, Not Excuses

A great broker is proactive. They should come to you with things like: “We can save money by bundling benefits.” Or, “Let’s consider a custom employee benefit package that includes mental health coverage and telemedicine.”

They’re bringing innovation to your doorstep, not excuses for why your rates keep rising.

If your broker hasn’t introduced a new idea in the past year, they’ve gone stale. And stale doesn’t cut it in a benefits landscape that changes this fast.

8. Acting as Your Strategic Partner, Not a Paper Pusher

Here’s the uncomfortable truth: most brokers technically work for the carriers, not for you. Premium increases often mean bigger paychecks for them.

A real benefits consultant works for your goals, aligns with your budget, gets to know your company, and focuses on value. They should feel like part of your internal team. If they don’t, it’s time for a second opinion.

Don’t Let Renewal Season Be a Blind Spot

Renewal season is your chance to reset not just your plan, but your entire benefits strategy. And if necessary, your relationship with your broker.

If your broker isn’t asking the right questions, negotiating hard, explaining changes clearly, or helping employees understand their coverage, they’re not your advocate. They’re your middleman.

You deserve a partner who digs in, challenges assumptions, and builds a benefits plan that makes sense for your people and your budget. Because the biggest renewal mistake isn’t a missed discount or a rate hike—it’s trusting someone who has stopped earning your trust.

Video

Infographic

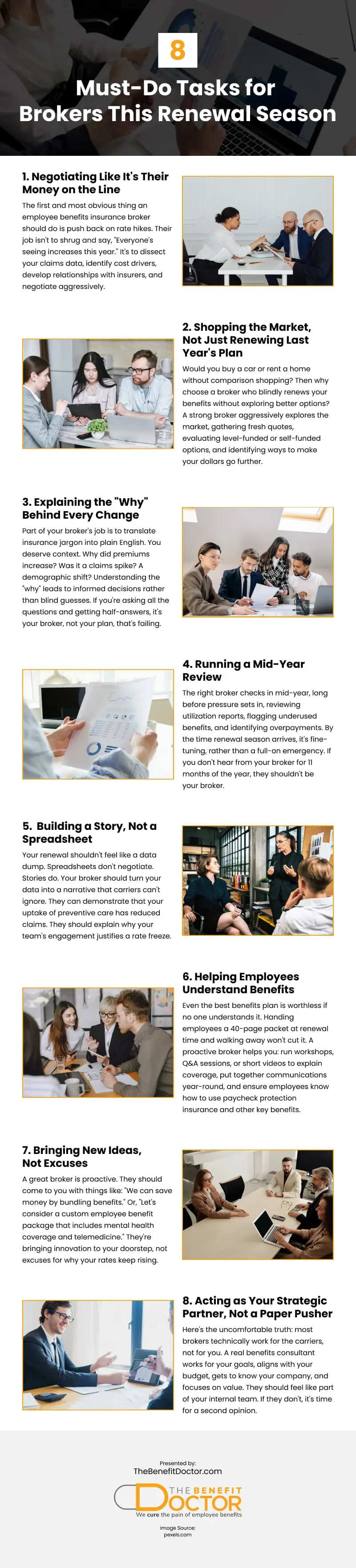

Renewal season is when your employee benefits broker should prove their value—not disappear or show up with a last‑minute rate hike and excuses. Explore this infographic to learn the eight essential tasks every broker must complete during renewal season.