Working with a benefits broker can feel like gambling with your budget. You hope you picked someone competent. You assume they’ll spot problems before they explode. And you worry about whether they’ll drag you into another renewal season where you walk out wondering why your medical premiums have ballooned like they’re trying out for a role as a parade float.

The right broker becomes an asset; the wrong one becomes a liability.

If you’ve ever marched into renewal season feeling confused, pressured, or suspicious that they’re leaving out something important, the issue probably wasn’t your benefits plan. It was the person handling it.

You deserve a partner who brings strategy, clarity, and innovative employee benefit solutions long before renewal season even hits. They should talk to you like a partner, not like someone stapling forms and calling it a day. When you know what to look for, it becomes easy to separate the pros from the pretenders.

Here are seven qualities you should expect from any broker who claims to know their craft. If they’re missing even one of these, it’s time to ask some hard questions.

1. They Ask Smart Questions Before They Try to Fix Anything

A real pro doesn’t walk in flashing a ready-made plan like a street magician with one trick. They start by asking questions that help them understand your business and your people. You’ll hear things like:

“What problem are you actually trying to solve with this plan?”

“What do your employees complain about the most?”

“Where did your unused spend come from last year?”

At first, these questions feel almost too simple. Then you realize no one has ever asked them before.

A strong broker wants the whole picture. They’re digging for patterns, weaknesses, and missed opportunities. While you’re explaining your current frustrations, they’re mapping your blind spots. They’ll highlight details you hadn’t even considered: the turnover spike in a specific department, the gaps in your communication plan, or the fact that no one has touched your wellness resources since the Obama administration. Thoughtful questions reveal what you actually need instead of what you’ve always been sold.

And remember, a thoughtful broker doesn’t treat your benefits plan like a museum artifact: looking but not touching. They refine it, sharpen it, and update it. Every year is an opportunity to upgrade the system. If your broker jumps straight to a solution without asking deeper questions, they’re basically guessing.

2. They Wield Data Like a Weapon

Forget about the brokers who drop giant spreadsheets on your desk and expect applause. A real broker turns your data into something you can use. Your claims breakdown gets translated into trends. Waste becomes obvious. Risk becomes predictable. And suddenly, you’re not relying on hunches anymore; you’re making decisions with precision.

Data is the difference between reacting in panic and planning with confidence. A data-fluent broker will show you:

- Where your highest claims are coming from

- Which age groups are using which benefits

- Which chronic conditions are quietly draining your budget

- Where you’re overpaying without realizing it.

When renewal season comes around, these insights become your leverage. A savvy broker uses your data and challenges carriers, pushes for better terms, and questions every increase that looks suspicious. They negotiate with receipts, not optimism. If your broker isn’t using data like a weapon, you’re playing the game with one hand tied behind your back.

3. They Communicate Clearly and Often

You shouldn’t have to chase your broker like a missing Amazon package. A high-performing broker doesn’t disappear for nine months and show up only when renewals hit. They check in. They send updates. They answer questions before you have to repeat them twice.

Most importantly, their communication feels human. They don’t hide behind acronyms or jargon. They explain options in normal words. They walk you through timelines. They give you honest expectations.

And their communication doesn’t stop with you. A strong broker also supports your employees. During open enrollment, they show up. They answer questions. They help employees understand what they’re paying for and how to actually use it. When communication flows smoothly, people feel supported rather than overwhelmed.

4. They Actually Understand Modern Funding Strategies

The benefits world evolves rapidly, and half the market is still arguing about solutions from 20 years ago. Your broker should be familiar with the modern landscape, including level-funded plans, self-funded plans, hybrid models, reimbursement strategies, and methods to build flexibility without setting your budget on fire.

A worthwhile broker explains how each funding model impacts your cash flow, risk profile, long-term costs, and employee experience. They don’t use scare tactics. They don’t sugarcoat potential risks. They provide you with the full picture, allowing you to make informed decisions rather than emotional ones.

When someone understands plan design at a deep level, they can help you prevent expensive misuse, redirect high-cost habits, communicate with your team, and structure benefits that work for real humans instead of theoretical spreadsheets.

5. They Turn Renewal Season Into Strategy Instead of Panic

Yes, your broker should be working with you and talking to you year-round, but renewal season is where brokers get exposed. If your broker sends you a renewal email with a giant increase circled and zero explanation, stop everything. That’s not partnership. That’s abandonment with a price tag.

A broker who knows their stuff fights for you. They push back on questionable underwriting assumptions. They negotiate. They explain what changed and why. They give you alternatives instead of telling you to accept the pain.

You’ll see comparisons of carriers, designs, add-ons, and funding options. You’ll see a breakdown of what’s driving the increase. You’ll see strategy instead of panic. And you’ll walk into renewal meetings knowing where your leverage is instead of hoping for mercy.

6. They Care Deeply About the Employee Experience

Benefits only matter if employees can use them. A competent broker knows this. They help you build a benefits ecosystem that supports your team’s mental, physical, and financial well-being. They bring clarity to enrollment. They support new hires. They walk employees through tools, not just terminology. And they do this year-round.

A great broker understands that when employees feel informed and supported, everything improves: retention, satisfaction, performance, loyalty. Benefits become a reason people stay, not a reason they complain.

7. They Bring Solutions That Actually Move You Forward

A truly capable broker isn’t stuck in the past. They bring fresh thinking, sharp strategy, and bold ideas. They should operate with the mindset of a strategist, not a salesperson.

A broker like this helps you future-proof your plan. They guide you with clarity. They simplify the complexity. And they make sure your benefits support the workforce you have today and the workforce you want tomorrow.

If you want a simple label for the capability you should expect, look for an employee benefits brokerage that brings strategy, transparency, and a relentless focus on outcomes. That’s the broker who will help you future-proof your plan.

Ready to Raise Your Standards?

If you spotted gaps between this list and what you’re getting today, it might be time to raise your standards. Benefits are too important to leave in the hands of someone who can’t guide you with insight and confidence. Partner with someone who sees where the industry is going and can help you build a plan ready for the next few years, not just the next renewal.

Video

Infographic

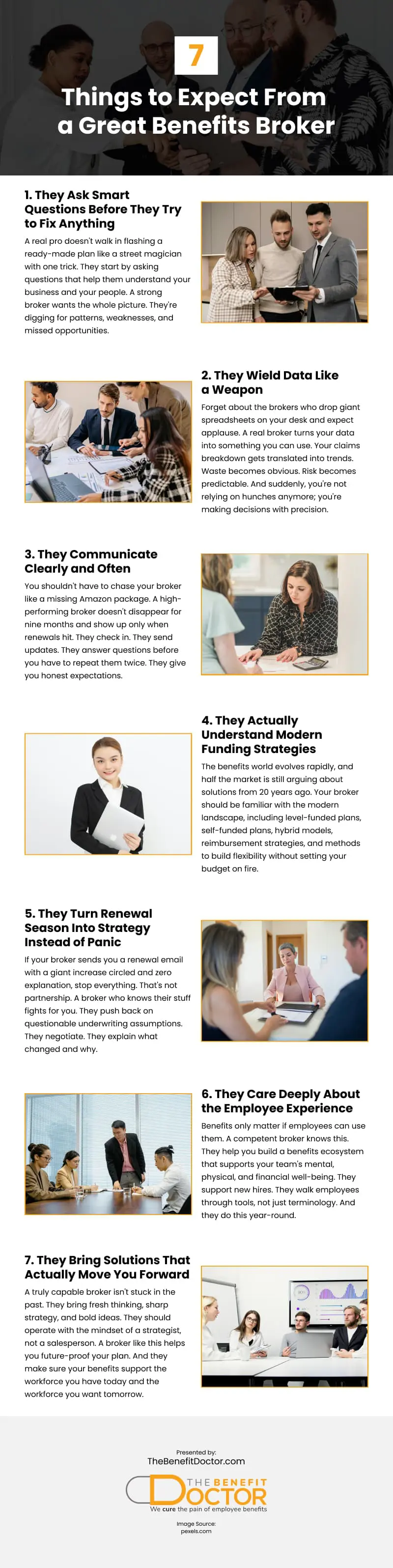

The right broker can elevate your benefits plan, while the wrong one can leave you confused and unsupported. This infographic highlights seven essential qualities every broker should demonstrate if they truly understand their craft.