If you’re like most business owners, the health insurance selection process already feels like it’s held together with duct tape and wishful thinking. And when you don’t have clarity, benefits are like gingerbread houses without frosting—structurally unsound and quick to crumble. Plans pile up, the fine print is overwhelming, and every provider promises they’ll save you money. So when a health insurance broker steps in promising to simplify things, it’s tempting to nod politely and move on without really digging into their role.

That’s where problems start.

Too many employers are making decisions based on old assumptions about what brokers do, how they’re paid, and whether they’re truly advocating for your best interests. Those myths cloud your judgment. But that’s not the worst of it. These misconceptions can quietly drain your budget and limit your ability to offer benefits that attract and retain talent.

When you understand what health insurance brokers for business really bring to the table and where conflicts of interest can sneak in, you’re in a much stronger position to negotiate, plan smarter, and avoid overpaying.

Myth #1: Brokers Work for You

It’s comforting to think your broker is your advocate and nothing else. After all, they help you pick a plan and answer questions when issues pop up. But here’s the catch. Most brokers are paid commissions by the carriers they recommend.

That means they technically work for the insurer, not for you.

A good broker will try to do right by their clients, but incentives matter. Higher commissions often come from higher-cost plans, and a broker might not suggest innovative structures, such as level-funded or self-funded plans, because they pay less. Unless you ask, you may never know what your broker actually earns.

If you assume they’re always neutral, you could be nudged toward plans that fit the insurer’s bottom line more than your own. Not every broker works this way, though. Look for a broker who has the best interest of your business and employees in mind, not their earnings.

Myth #2: Brokers Are Free

This one gets repeated so often that it sounds like a fact. “There’s no cost to you.” Technically, it’s sometimes true that you don’t cut a check to your broker. However, no broker works for free. If you don’t pay them directly, someone does, and that’s usually the insurance company. The insurer pays the broker by taking money from your premiums. The more you spend, the more the insurer makes and the broker earns.

That doesn’t mean every broker is out to pad their paycheck. Many deliver excellent service despite this setup. But you should understand the dynamic. Blind trust can mean rewarding higher premiums instead of leaner, smarter coverage.

A better move? Ask your broker to disclose their compensation, or work with one who offers a fee-based model where you pay a flat consulting fee. That way, their paycheck doesn’t rise with your costs. If they’re not making money by upselling, they have no incentive to push pricier plans you don’t need.

Myth #3: All Brokers Offer the Same Plans

Yes, most brokers have access to the big carriers in your area. But not all bring the same level of creativity or strategy.

If your broker only shows you three options from the same household names every renewal season, you’re missing out. They may not be quoting level-funded plans, exploring partially self-insured options, or partnering with TPAs (third-party administrators) who can design more tailored offerings.

Strategies like reference-based pricing, carve-out pharmacy programs, or concierge services may never hit your radar unless your broker thinks beyond the standard playbook.

Myth #4: Switching Brokers Is Too Complicated

Many employers stick with a less-than-stellar broker because they fear the hassle of switching. The truth? It’s surprisingly simple.

You don’t need to change carriers. You don’t need to rebuild your benefits setup from scratch. And you don’t need to wait until year-end.

In most cases, all it takes is signing a broker-of-record (BOR) letter that transfers your account to a new broker. Your employees won’t even notice the change until they start seeing the improvements in their benefits.

So don’t let the fear of paperwork keep you tied to a stagnant relationship.

Myth #5: Brokers Are Only for Big Companies

If you’re running a 20-, 30-, or 50-person team, you might assume you’re too small to benefit from a broker. But smaller businesses still benefit from using a broker.

It’s easy to make costly mistakes when building benefits packages for a small or growing business. A strong broker helps build employee benefits packages for small businesses that avoid those pitfalls. They help ensure your plans are compliant, cost-effective, and attractive enough to retain talent.

The right broker is often the closest thing to having a benefits manager on staff, without the added payroll cost.

Myth #6: Your Broker Is Proactively Monitoring Costs

You probably expect your broker to keep tabs on your costs throughout the year, especially if your premiums keep climbing. But in reality, many take a “renewal-only” approach. They show up once a year, present a few quotes, and disappear.

That’s not strategy. It’s not support. It’s the bare minimum.

A strong broker should help you track claims utilization, flag cost drivers, and forecast trends. That way, you’re ready long before renewal season. Without that ongoing support, you’re flying blind.

Expect more. Your broker should help set a long-term benefits strategy, not just shuffle quotes once a year.

How to Break Free From the Myths

If these myths sound familiar and you’ve made decisions based on misconceptions, don’t beat yourself up. The benefits industry isn’t exactly famous for transparency. But that doesn’t mean you’re stuck.

Here’s how to take control:

- Ask your broker to disclose their commission structure or request a fee-based model.

- Request a full market analysis that includes alternative funding approaches.

- Clarify how often you’ll meet during the year and what kind of reporting you’ll get.

- Push for strategies that go beyond the big three carriers.

- Explore how they will assist you in rolling out your benefits and collaborating with your team to understand what is included in your plan.

And most importantly, remember that your broker should be a strategist, not a salesperson. If they’re not helping you make smarter decisions, negotiate better rates, and educate your team, they’re not doing their job.

Myths: Busted

A comprehensive employee benefits package is one of the most significant and expensive investments you make in your business. Don’t let myths, assumptions, or outdated practices guide your choices.

You deserve a broker who’s transparent, proactive, and aligned with your goals. When you move past the myths and start asking sharper questions, you stop treating benefits as a headache and start turning them into a business advantage.

That’s the difference between limping through renewal season and building a benefits strategy that actually works for you and for the people counting on you.

Video

Infographic

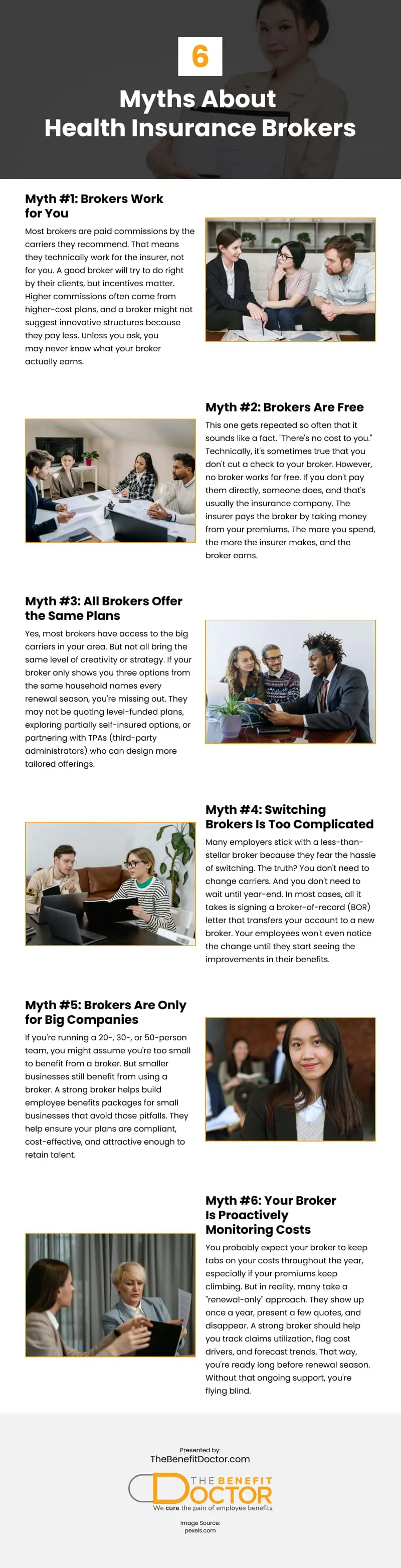

Many employers still rely on outdated assumptions about insurance brokers and what they actually do—assumptions that can quietly undermine budgets and talent strategies. Check out this infographic to learn the truth behind common myths about health insurance brokers.